Instant Loan for Students Without Income Proof – आजकल education aur lifestyle dono ke liye students ko loan की ज़रूरत पड़ती है। लेकिन सबसे बड़ा challenge है income proof या salary slip। Majority students के पास job नहीं होती, इसलिए उनके लिए bank loan लेना मुश्किल हो जाता है। लेकिन good news ये है कि instant loan apps aur NBFCs के through students को instant loan without income proof मिल सकता है।

इस पोस्ट में हम detail में जानेंगे:

- Student के लिए loan options बिना income proof

- Eligibility, documents aur loan apps list

- Instant loan process

- FAQs (Frequently Asked Questions)

- SEO oriented keywords aur tags

What is Instant Loan for Students Without Income Proof?

Instant loan for students एक ऐसा financial option है जिसमें आपको salary slip या job certificate देने की ज़रूरत नहीं होती। ये loan mainly fintech apps aur NBFCs provide करते हैं। ये छोटे amount के होते हैं (₹5,000 – ₹2 lakh तक) aur short tenure के लिए available होते हैं।

Key Features of Student Instant Loan without income proof

| Feature | Details |

|---|---|

| Loan Type | Personal Loan / Education Loan |

| Proof Required | Basic KYC (Aadhar, PAN), College ID |

| Loan Amount | ₹5,000 – ₹2,00,000 |

| Interest Rate | 12% – 28% (Depends on lender) |

| Tenure | 3 months – 36 months |

| Processing Time | Instant approval in 5 minutes |

| Eligible Users | Students, freelancers, part-time earners |

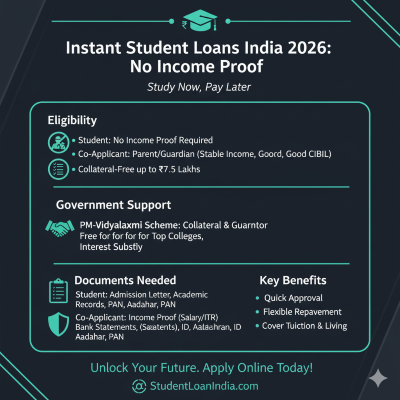

Eligibility Criteria

- Applicant की age 18 years ya usse zyada होनी चाहिए।

- Valid college ID card या admission proof.

- Aadhar & PAN card compulsory.

- Active bank account.

- कुछ lenders minimum CIBIL score मांग सकते हैं, लेकिन कई apps बिना CIBIL check भी loan देते हैं।

Documents Required (No Income Proof Needed)

- Aadhaar Card

- PAN Card

- Student ID / Admission Letter

- Bank Account Statement (optional)

- Passport Size Photograph

Top Instant Loan Apps for Students Without Income Proof

| Loan App | Loan Amount | Interest Rate | Key Benefit |

|---|---|---|---|

| KreditBee | ₹1,000 – ₹2 Lakh | 18% – 24% | Fast approval for students |

| Slice Card | ₹10,000 – ₹10 Lakh | Flexible | Works as credit card for students |

| LazyPay | ₹1,000 – ₹1 Lakh | 15% – 28% | Instant small loans |

| MoneyTap | ₹3,000 – ₹5 Lakh | 13% – 20% | Credit line facility |

| CASHe | ₹7,000 – ₹3 Lakh | 16% – 28% | No heavy documentation |

Advantages of Instant Loan without income proof for Students

- No income proof required

- Instant approval (5 minutes – 24 hours)

- Fees, gadgets, emergency ke liye use kar sakte ho

- Flexible repayment options

- Available on loan apps & NBFCs

Disadvantages You Must Know

- Higher interest rate than bank loans

- Small loan amount limit

- Short repayment tenure

- Delay in payment affects CIBIL score

How to Apply for Instant Loan Without Income Proof?

- Loan app download karein (KreditBee, Slice, MoneyTap, etc.).

- KYC verification complete karein.

- Loan amount & tenure select karein.

- Basic documents upload karein (Aadhar, PAN, College ID).

- Loan amount directly bank account me transfer ho jata hai.

FAQs – Instant Loan for Students

Q1. क्या बिना income proof के student loan मिल सकता है?

👉 हां, fintech loan apps students को instant loan dete hain without income proof.

Q2. Minimum age कितनी होनी चाहिए?

👉 कम से कम 18 years.

Q3. कितना loan मिलता है बिना salary slip के?

👉 ₹5,000 से ₹2 lakh तक.

Q4. क्या CIBIL score जरूरी है?

👉 हर lender के rule alag होते हैं, लेकिन कुछ apps without CIBIL bhi loan dete hain.

Q5. क्या repayment आसान है?

👉 हां, EMI aur flexible tenure options available hote hain.

Conclusion for How to Get Student Loan Instantly Without Salary Slip or Income Proof

आज के digital era में students ko loan lene ke liye job certificate ya income proof dene ki zarurat nahi hai. NBFCs aur loan apps ne process ko fast, easy aur hassle-free बना दिया है। लेकिन ध्यान रहे कि interest rates thode high होते हैं और timely repayment जरूरी है। अगर आपको college fees, exam preparation, gadgets ya emergency expenses के लिए पैसा चाहिए, तो instant loan without income proof एक useful option हो सकता है।

👉 Suggestion: Loan लेने से पहले terms & conditions aur interest rate ध्यान से पढ़ लें।